SR22 Insurance Quotes Online

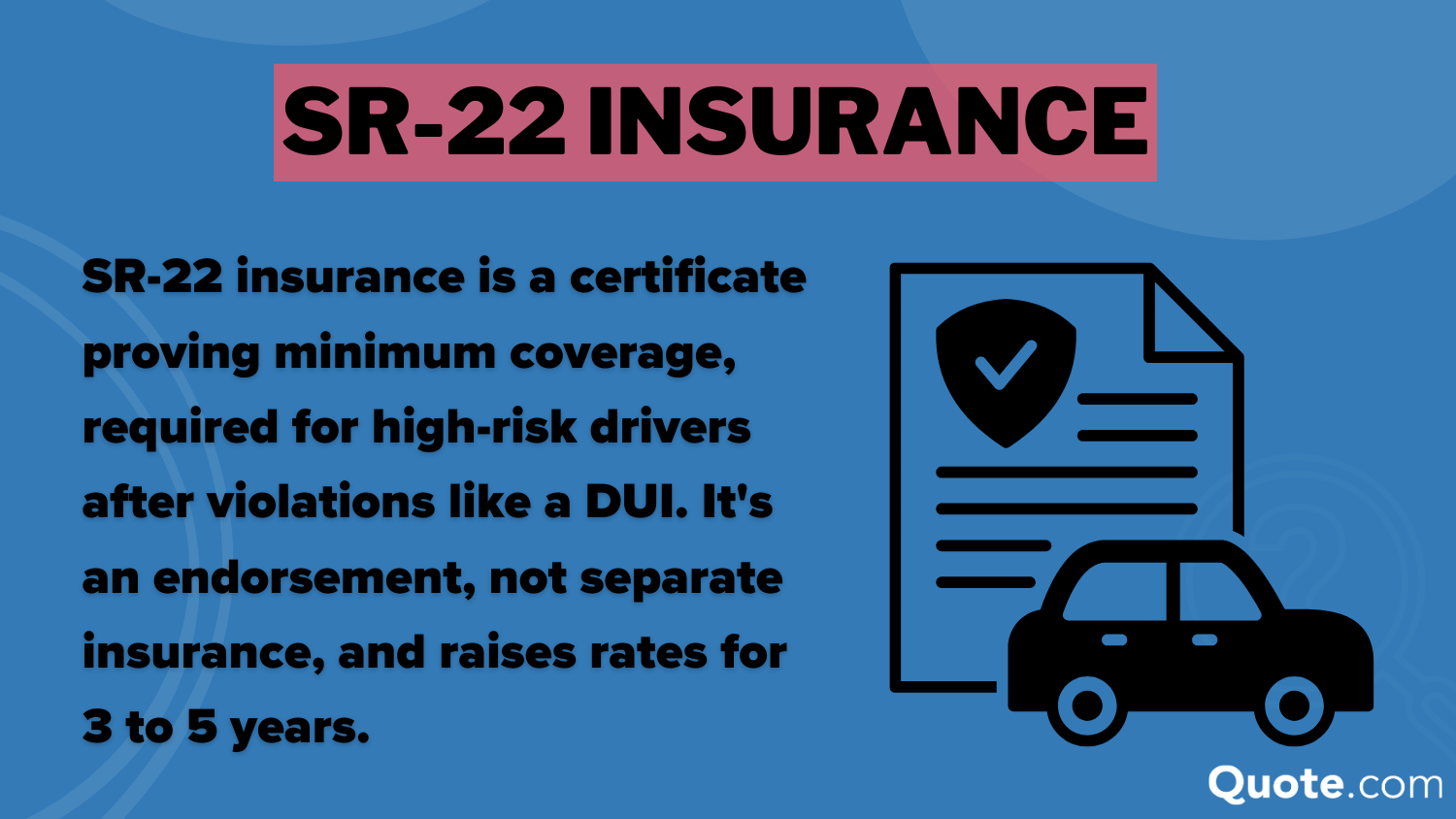

SR22 insurance is a certificate of financial responsibility required by many states for drivers who have been involved in serious traffic violations, such as DUIs, driving without insurance, or multiple accidents.

It is not a standalone policy but rather an endorsement added to your existing auto insurance, ensuring proof of coverage is filed with the state.

Comparing SR22 insurance quotes online makes the process faster, more convenient, and often more affordable.

Because SR22 is often associated with higher risk drivers, premiums may be higher than standard insurance policies.

However, using online tools to shop around helps you find the most competitive rates while still meeting state requirements.

Fast and Affordable Coverage Solutions

Why Get SR22 Quotes Online?

Obtaining SR22 insurance quotes online allows drivers to compare multiple providers instantly.

This saves time, reduces paperwork, and ensures you select an insurer authorized to file the SR22 form on your behalf.

Many online platforms also provide same-day filing options, helping you reinstate your driving privileges quickly and without unnecessary delays.

Factors That Affect SR22 Insurance Costs

Several factors influence SR22 insurance rates, including your driving history, the reason for the SR22 requirement, your state’s regulations, and the type of coverage you choose.

Premiums can vary widely, making comparison shopping essential for cost savings.

Maintaining a clean driving record while under an SR22 requirement can also help reduce costs over time.

How Long Is SR22 Insurance Required?

Most states require drivers to maintain SR22 coverage for 2 to 5 years, depending on the severity of the violation.

Failing to maintain continuous coverage can result in penalties, including license suspension or extended SR22 filing requirements.

Understanding your state’s rules ensures you remain compliant and avoid unnecessary legal or financial issues.

Choosing the Right Provider

When selecting an SR22 insurance provider, it is important to choose a company experienced in handling high-risk policies and state filings.

A knowledgeable insurer will not only file the SR22 form correctly but also help you manage costs and maintain coverage requirements.

By comparing SR22 insurance quotes online, you can quickly find affordable options that meet legal obligations while restoring your driving privileges with confidence.