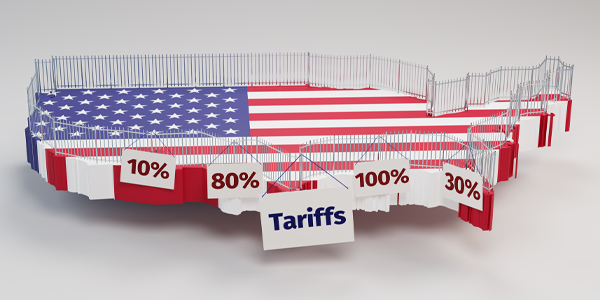

How New U.S. Tariffs Are Impacting Consumer Prices

Recent increases in U.

S.

tariffs, particularly those targeting Chinese imports, are significantly affecting consumer prices across various sectors.

With tariffs on Chinese goods reaching up to 145%, consumers are experiencing noticeable price hikes on everyday items, from clothing to electronics.

These tariffs, aimed at protecting domestic industries, are leading to higher costs for imported goods, which businesses often pass on to consumers.

The following outlines the key ways these new tariffs are influencing consumer prices:

Understanding the Economic Ripple Effects on Everyday Goods

-

Apparel and Textile Price Increases

Tariffs have led to a 33% rise in apparel prices and an 18% increase in non-apparel textiles, making clothing and related items more expensive for consumers.

-

Automobile Costs Surge

The average price of cars has increased by approximately 15.

8%, translating to an additional $7,600 per vehicle, due to higher tariffs on imported automotive parts and vehicles. -

Food and Grocery Expenses Climb

Consumers are facing a 6.

2% rise in fresh produce prices and a 4.

5% overall increase in food costs, as tariffs affect the importation of various food items. -

Electronics and Household Goods Become Pricier

With tariffs impacting a significant portion of imported electronics, prices for items like smartphones and household appliances are on the rise, affecting consumer budgets.

-

Reduced Consumer Spending Power

On average, U.

S.

households are experiencing an annual loss of $3,800 due to increased prices from tariffs, with lower-income families disproportionately affected. -

Inflationary Pressures Intensify

Economists warn that the cumulative effect of tariffs could push inflation rates higher, potentially reaching near 5%, as the cost of goods continues to escalate.

-

Economic Growth Faces Headwinds

The broader economy is feeling the strain, with real GDP growth projected to be 0.

9 percentage points lower in 2025 due to the compounded effects of tariffs.